What the restart of defaulted student loan collection means for borrowers

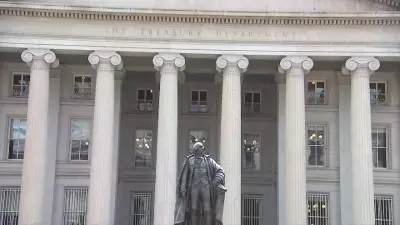

CNN The Department of Mentoring restarts collections of loans in default on Monday putting millions of borrowers at pitfall of having their benefits and wages garnished The move arrives as the Trump administration works to dismantle the Learning Department and aggressively roll back former President Joe Biden s policies including those around aspirant loan forgiveness It s expected to affect the more than million borrowers who are in default And that number could rise over the next scant months There are million additional borrowers in late-stage delinquency which occurs after days without payment the department disclosed in a news release last month Here s what we know so far What does it mean when federal aspirant loans are in default Federal apprentice loans go into default after days without payment If you are not in default the move to restart sending loans in default to collections will not affect you How do I know if I am in default When a novice loan goes in default it will be reflected on your credit overview You can check on the status of your loan by reaching out to your candidate loan servicer or visiting the Federal Learner Aid website for more information Experts who spoke with CNN recommend that even if you know your loans aren t in default you should still check on the status of your loans and stay informed on options available to you How can the cabinet garnish my wages and benefits As part of its move to resume collection of these debts the governing body has restarted the Treasury Offset Initiative which collects debts by garnishing federal and state payments such as tax returns or social guard benefits This will only apply to you if you are in default The Schooling Department also stated in April that it will restart the process of administrative wage garnishment this summer That allows the agency to order non-federal employers to withhold part of an employee s income to pay off the scholar loans in default How do I get out of default The Mentoring Department has urged borrowers in default to contact the trainee aid office s Default Resolution Group and make a monthly payment enroll in an income-driven repayment plan or sign up for loan rehabilitation Loan rehabilitation Borrowers in default are able to rehabilitate their loans by making nine voluntary uninterrupted payments over a -month period A borrower can only rehabilitate a defaulted trainee loan one time Read more on the process on the attendee aid office s website here Borrowers must first contact their loan servicer and agree in writing to make the payments The amount of the payments is set by the loan holder and borrowers must provide documentation of their income It will be equal to either or of your annual discretionary income divided by according to the Learning Department s website If you don t know who your loan servicer is you can find out through the Office of Federal Attendee Aid here After the nine consecutive payments are made the loan will no longer be in default status and the default notice will be removed from your credit analysis but having been in delinquency prior to the default will still be visible on your account If administrative wage garnishment was in place before the rehabilitation process began it would continue until the borrower has made at least five of the required nine payments Loan consolidation Loan consolidation allows borrowers to combine multiple federal pupil loans into one loan with a single monthly payment and no application fee Borrowers will have to pay any future interest on the higher balance which could cause them to pay more overall Borrowers can also switch to a different trainee loan servicer if they consolidate their loans The Direct Consolidation Loan Application is available here However for borrowers on an income driven repayment plan and looking for forgiveness after or years consolidation does restart that clock aspirant loan lawyer Jay Fleischman narrated CNN Can I get additional relief while I m in default According to the Department of Instruction s website if you go into default you can no longer receive deferment or forbearance which allow you to temporarily stop making payments on your loan You will also no longer have the ability to choose a repayment plan However once borrowers complete loan rehabilitation or consolidate to cure the default they regain access to deferment forbearance and income-driven repayment plans Fleischman reported The loss of these options does not depend on the loan being sent to collections he noted When a borrower defaults the law restricts these options until the loan is brought out of default Though the Trump administration is moving away from Biden-era efforts to forgive trainee loan debt there are other strategies for borrowers to discharge their debt Can I get rid of my candidate loans if I go through bankruptcy Unlike selected other consumer loans aspirant loans can only be discharged if a borrower meets certain specific criteria For several borrowers this is doable if they ve declared bankruptcy and demonstrate undue hardship More apprentice loan borrowers have successfully received debt relief through bankruptcy since the Biden administration simplified the burdensome process of showing undue hardship and made it easier for cabinet lawyers to recommend to courts that the debt be discharged People should look at what s called the Brunner Test because that s what s used bulk of the time in bankruptcy for participant loans and if they think they might fit the criteria it is something to explore participant loan expert Betsy Mayotte stated CNN The Brunner Test requires showing that a borrower cannot maintain a minimal standard of living if forced to repay the trainee loans that this financial situation will continue for the majority of the loan repayment period and that a good faith effort has been made to pay While it is unclear if the Trump administration will maintain the Biden administration s guidance Malissa Giles a consumer bankruptcy attorney from Virginia recounted CNN her perception is that the current administration will be less generous than the Biden administration was I personally think that if you don t meet those presumptive factors then it s going to be a lot lot harder under this administration to get an agreed decision of a hardship discharge or reaching a hardship discharge she added Make sure to watch out for scams Borrowers need to be aware of any scams that may deceive them with false promises of debt relief or more affordable payment plans Apprentice loan-related announcements like the one the Mentoring Department made last month make great talking points for scammers that go after chosen of the majority vulnerable borrowers and defaulted borrowers fall under that category Mayotte revealed There s never a fee to access rehabilitation or consolidation and paying someone a fee is not going to get it for you any faster or get you a better deal than you can by just doing it yourself she explained More information about avoiding novice loan related scams can be unveiled on the scholar aid office s website here